Alaska Expects 7,500 Job Losses

in 2017

Southeast Alaska forecasted to lose about 600 jobs

January 06, 2017

Friday AM

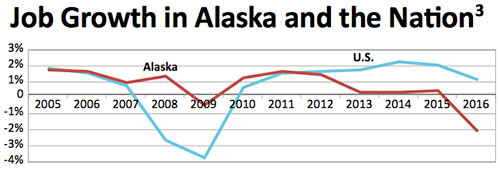

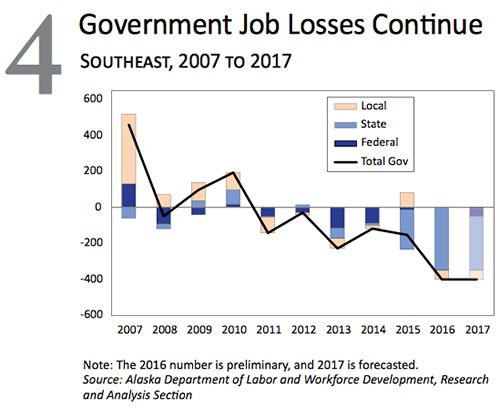

(SitNews) Ketchikan, Alaska - In 2016, job losses spread through nearly all sectors of Alaska’s economy, and a more broad-based decline is forecasted statewide for 2017. According to Heidi Drygas, Commissioner of the Alaska Department of Labor, "It has been a long time since Alaskans were confronted with such a challeng- ing economic landscape. In fact, our economy is shrinking faster than at any time since the 1980s. We lost 6,800 jobs last year."

The Alaska Department of Labor's 2017 economic forecast projects that job losses will continue in all sectors except health care, and layoffs will accelerate in sectors such as retail as the ripple effect of job losses impact aggregate demand and consumer spending.

Job Growth in Alaska and the Nation

Graph courtesy

January 2017: Employment Forecast for 2017

Alaska Economic Trends Magazine

According to Caroline Schultz, an economist statewide with the Department of Labor, employment losses began statewide in the last months of 2015 in the industries directly related to oil production, after prices fell. Initial loss was limited to the oil and gas industry and closely related sectors, including construction, professional and business services, and state government. In 2016, statewide losses spread into sectors not directly related to the oil industry.

More downstream job losses are expected this year statewide. After a 2.0 percent employment decline in 2016, the state is forecasted to lose 2.3 percent, or about 7,500 jobs, in 2017. This reflects decline in nearly every major industry, but while the net loss will likely be bigger than in 2016, direct oil-related losses are expected to slow.

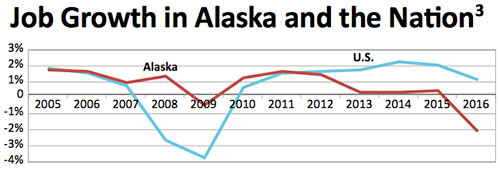

Southeast Alaska 2016-2017

Graph courtesy

January 2017: Employment Forecast for 2017

Alaska Economic Trends Magazine

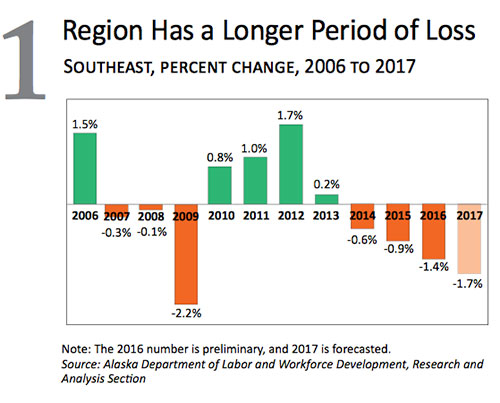

Conor Bell, an economist at the Alaska Department of Labor in Juneau, reports in the January 2017 edition of Alaska Economic Trends, that Southeast Alaska is forecasted to fare slightly better than the state as a whole in 2017, a first in recent years. Southeast Alaska has underperformed the state overall for some time, plus it lost a greater share of jobs in 2009 — the only year Alaska lost jobs during the national recession — and regained fewer in the years that followed. With that tepid history the region has less ground to lose.

Southeast began to shed state government and construction jobs in 2015, and like the rest of the state, the effects are seeping into the secondary industries that depend on how well the region’s economic drivers fare.

Southeast is disproportionately affected by weakness in state government, but the region has almost none of the oil and gas employment that has been the state’s biggest source of loss reports Bell. Southeast also has more of a buffer from tourism than other regions, which will further temper its losses.

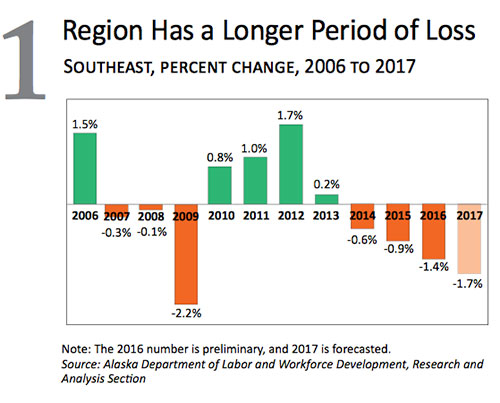

Southeast Alaska Job Forecast by Industry

For a larger image click here or on graphic.

Graph courtesy

January 2017: Employment Forecast for 2017

Alaska Economic Trends Magazine

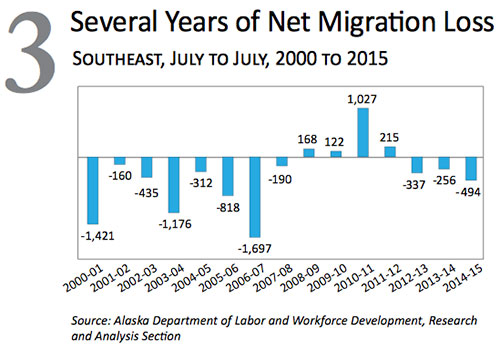

Migration and an aging Southeast Alaska population

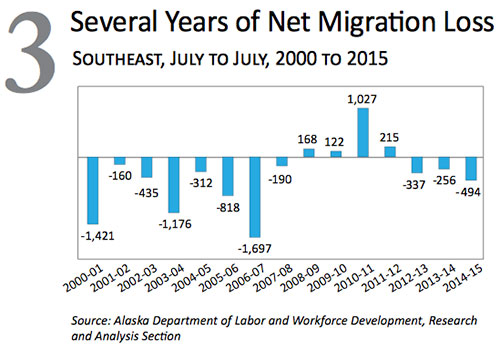

In the January 2017 Economic Trends, Bell reports that more people left Southeast than moved in between July 2014 and 2015, a trend that’s likely to continue statewide. The region lost about 500 people through net migration over the period, and though natural increase largely offset that loss, births don’t mitigate migration’s effect on the current working-age population. Fewer working-age people means less competition for jobs, but it also means fewer people spending money in their communities according to Bell.

Bell reports the Southeast region is also older than the state overall, and its largest age group is between 50 and 59. Many baby boomers moved in when Alaska was awash in oil money during the late 1970s and early 1980s, and they will continue to age out of the workforce in the near future.

In a lackluster economy in Bell's words, not all vacated jobs will be refilled, but these retirements will open some job opportunities despite lower employment. However, workers who have built up their salaries over time will often be replaced by young workers who will be paid less, dampening the region’s total wages.

Southeast Alaska Migration Loss

Graph courtesy

January 2017: Employment Forecast for 2017

Alaska Economic Trends Magazine

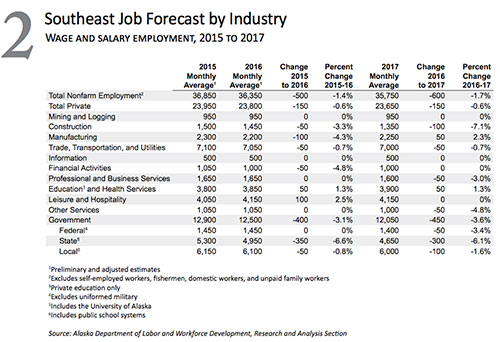

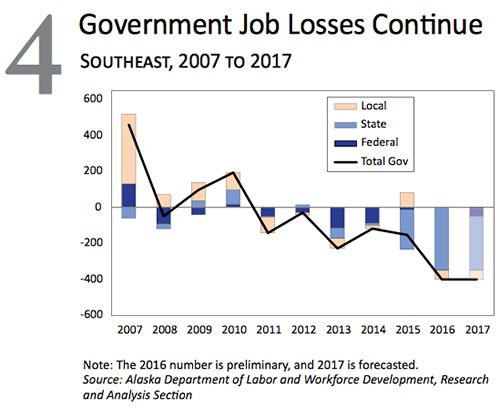

Most Southeast Alaska job loss will be in government

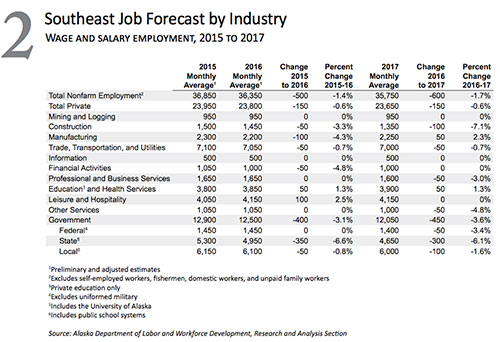

Southeast Alaska lost more than 500 state government jobs between 2014 and 2016, and state government is expected to remain the fastest-losing industry this year, at 300 jobs.

Cuts will likely slow in the coming fiscal year according to Bell, though, with less low-hanging fruit remaining. After two years of cutting costs in government, opportunities for savings will be harder to find. While layoffs seem certain, most state government losses will continue to come from attrition in 2017. Baby boomers are still reaching retirement age, and many of their positions will be eliminated or left unfilled.

Federal government employment in Southeast Alaska has been flat for the past few years and is forecasted to decline slightly in 2017 states Bell. Prior to its recent stability, federal employment fell continually for a decade except in 2010 when the U.S. Census was conducted.

Bell writes that local government in Southeast has also remained fairly steady amid steep declines in state funding, with a small loss of 50 jobs in 2016. This year will likely be slightly harder for school districts and local governments due to diminishing state funding. Even if schools sustain sharp funding cuts, though, they won’t feel them until the next school year begins in the fall.

Tribal government, which is counted as part of local government, will likely fare better, as it’s largely federally funded writes Bell.

Government Job Losses in Southeast Alaska

Graph courtesy

January 2017: Employment Forecast for 2017

Alaska Economic Trends Magazine

Fishing to rebound after a dismal 2016

Commercial fishing is a significant part of Southeast’s economy, but because most harvesters are self-employed, their jobs aren’t part of Bell's 2017 forecast. Still, according to Bell, 2017 is set to be a markedly better year for fishermen than 2016, which had lower-than-expected pink salmon runs compounded by low prices.

Odd years tend to have bigger pink salmon runs, and the Alaska Department of Fish and Game forecasts a higher-than-average harvest of 43 million pinks in 2017. Prices have also rebounded somewhat since last summer, partly due to the weaker-than-expected runs. A potential tariff on U. S. imports could hurt prices, though, as fish is commonly exported to China, processed, and imported back into the U. S.

While a better fishing season doesn’t necessarily mean more people fishing, as many vessels operate with a fixed number of crew, those harvesting in 2017 are likely to earn more because they’re typically paid a share of their vessels’ revenue, reports Bell.

Seafood processing jobs, which make up the bulk of Southeast’s manufacturing sector and are included in this Southeast Alaska 2017 forecast’s data, are expected to get a corresponding boost this year from the higher catch volume.

Construction will continue to decline in Southeast Alaska

A third year of minimal capital budgets is all but certain reports Bell, and while the Southeast construction industry hasn’t yet sustained the full impact of the change because past funding from larger budgets has carried over, that pool is diminishing.

Bell reports a handful of major projects will continue in 2017. The Haines highway project, which received $30 million in federal funding, is the biggest. Others include the Juneau capitol building upgrade, the Tenakee ferry terminal project, and improvements to Juneau’s Glacier Highway.

Federal transportation funding will remain strong, with four years left of the generous Fixing America’s Surface Transportation Act. Bell reports that federal funding won’t be enough to counter minimal state funding and dreary economic conditions, though, so the industry in Southeast Alaska is forecasted to lose 100 jobs in 2017.

Tourism will boost some Southeast Alaska Industries

Though decreased economic activity in Southeast Alaska may put a dent in locals’ spending, summer tourism will remain strong as long as the U. S. economy is growing.

Southeast had more than 1 million cruise ship visitors in 2016, and 2017 is set to be just as big. Tourism is more significant in Southeast, write Bell, than the state as a whole, and it will shield restaurants and stores from the drop in business anticipated elsewhere.

The Southeast trade, transportation, and utilities sector, which is tied to tourism as well as local consumption, fell by a modest 50 jobs in 2016. This year’s forecast is similar. Walmart closed its Juneau location partway through 2016, so last year’s data reflected only part of the loss. And while a strong tourism season will boost retail and transportation employers, declining local incomes will reduce demand during the rest of the year and counter visitor-related gains.

Leisure and hospitality is even more heavily based in tourism in Southeast Alaska, and it’s forecasted by Bell to hold steady in 2017. While restaurants and bars will perform worse outside of the summer months due to less local spending, reports Bell, visitor spending on everything from tours to hotels will probably be enough to keep the industry stable.

Other private Southeast Alaska industries

The education and health services sector includes private health care and social assistance as well as private education, though Southeast has little of the latter. Private health care in Southeast has historically underperformed the state overall, reports Bell, partly due to the region’s recent economic stagnation, but it grew somewhat in 2016 and is likely to add jobs again in 2017. Growth is also likely in the long term, mostly to serve the region’s aging population. Social assistance was stable in 2016 but will be vulnerable to decreased state and federal funding.

Southeast mining employment is forecasted by Bell to hold steady through existing mines and contractors. Exploration employment is minimal, and no potential sites are expected to open in the near future. (January 2017 Alaska Economic Trends - Read Conor Bell's full article.)

Statewide

Schultz, an economist with the Department of Labor, reported statewide this year will be characterized by widespread reductions in Alaska in the service industries that depend on consumer spending, which will be dampened by lost wages and lower confidence.

State faces two major hurdles

Alaska’s economy faces two major obstacles related to the drop in oil prices: a significant shedding of jobs by employers sensitive to oil prices, and state government’s budget dilemma reports Schultz. The main uncertainty about Alaska’s economic future has less to do with oil prices, which are influenced by factors well beyond the state’s control, and more to do with political decisions on the size and funding source of state government. (January 2017 Alaska Economic Trends - Read Caroline Schultz' full article)

According to Neal Fried an economist with the Department of Labor in Anchorage, after nearly 30 years of modest but mostly steady growth, Anchorage lost more than 3,000 jobs in 2016, or about 2.3 percent of its employment. With those losses came a 4 percent drop in total wages. (January 2017 Alaska Economic Trends - Read Neal Fried's full article.)

According to Alyssa Rodrigues an economist at the Department of Labor in Anchorage, military plans will soften some of Fairbanks' job losses. The Fairbanks North Star Borough’s employment levels have been up and down over the past decade. Since the 2012 peak, though, the trend has been mostly down, with the exception of a scant 0.3 percent gain in 2015.

In 2016, employment in the Fairbanks North Star Borough fell by 1.9 percent, bringing Fairbanks back to 2006 levels. A similar loss of 2.0 percent is forecasted for 2017. Like the rest of the state, Fairbanks’ job losses are related to the decline in oil prices. According to Rodrigues, the borough has a few opportunities for growth in 2017, though, including a massive investment in Eielson Air Force Base as it prepares to house two long-awaited F-35s. (January 2017 Alaska Economic Trends - Read Alyssa Rodrigues' full article)

Reporting & Editing by Mary Kauffman, SitNews

On the Web:

January 2017: Employment Forecast for 2017

Alaska Economic Trends Magazine

http://www.labor.state.ak.us/trends/jan17.pdf

Published montly by the Alaska Department of Labor's Research and Analysis Section

Source of News:

January 2017: Employment Forecast for 2017

Alaska Economic Trends Magazine

http://www.labor.state.ak.us/trends/jan17.pdf

Representations of fact and opinions in comments posted are solely those of the individual posters and do not represent the opinions of Sitnews.

Submit A Letter to SitNews

Contact the Editor

SitNews ©2017

Stories In The News

Ketchikan, Alaska

|

Articles &

photographs that appear in SitNews may be protected by copyright

and may not be reprinted without written permission from and

payment of any required fees to the proper sources.

E-mail your news &

photos to editor@sitnews.us

Photographers choosing to submit photographs for publication to SitNews are in doing so granting their permission for publication and for archiving. SitNews does not sell photographs. All requests for purchasing a photograph will be emailed to the photographer.

|

|