The Alaska Recession's Impact on EmploymentBy MARY KAUFFMAN

February 17, 2018

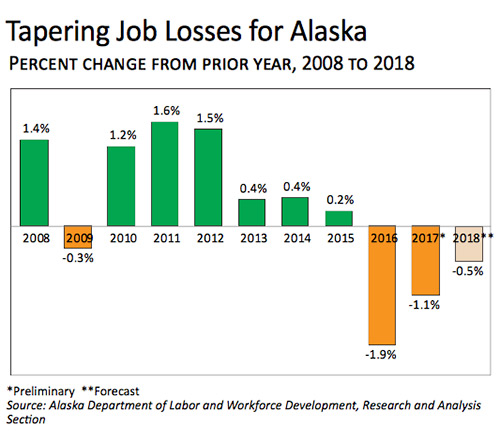

In a recent edition of Alaska Economic Trends, Wiebold reported that total employment statewide is forecasted to decline by 0.5 percent in 2018 (a loss of -1,800 jobs) after falling 1.1 percent in 2017 and 1.9 percent in 2016.

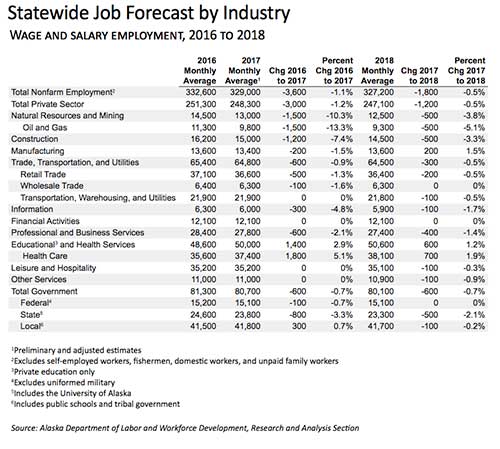

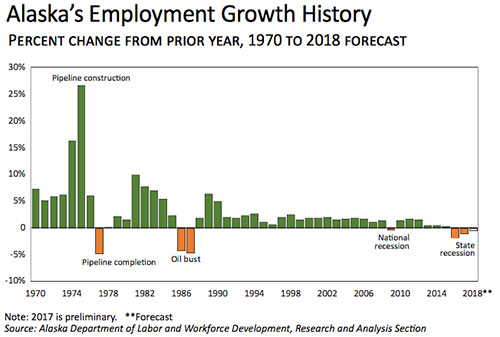

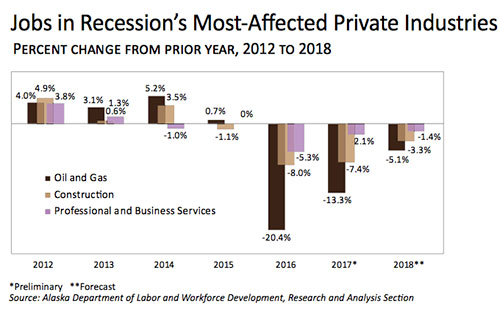

Losses were deepest in 2016, wrote Wiebold, when the state’s economy shed 6,300 jobs, primarily in oil and gas and in state government. Then in 2017, Alaska lost an estimated 3,600 jobs. If it hadn’t been for strong health care growth, the overall job loss would have been deeper, according to Wiebold. If employment follows the forecasted pattern this year, that would put Alaska’s total loss from 2015 through 2018 at 11,700 jobs (-3.5 percent). How job losses are panning out One reason statewide losses are slowing, according to Wiebold, is that oil and gas, state government, professional and business services, and construction have already taken significant hits over the last couple of years and their job counts are stabilizing at lower levels. However, the impact from those losses will reverberate into stores, bars and restaurants, and a variety of other employers that depend on consumer, business, and state government spending, according to Wiebold. Alaska's Recession’s first wave: State government and oil Economist Wiebold reported when oil prices plummeted in late 2014, state government was the first to feel the pinch as falling tax revenue from the oil and gas industry decimated state revenues. State government began to cut jobs in early 2015 as pressure mounted to reduce expenses, including its payroll and capital projects. Oil and gas lost a whopping 2,900 jobs in 2016, followed by state government at 1,200 jobs, professional and business services (such as engineering, geological, and architectural firms) at 1,600, and construction at 1,400. Alaska’s oil and

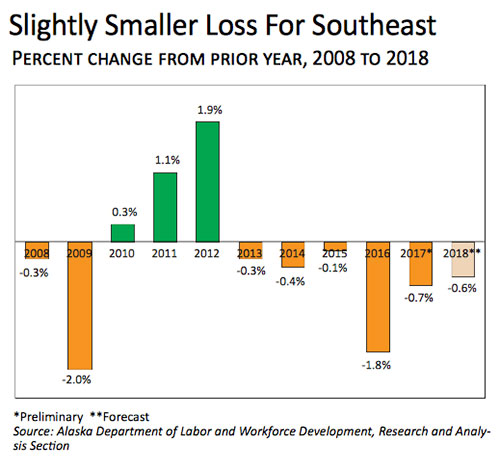

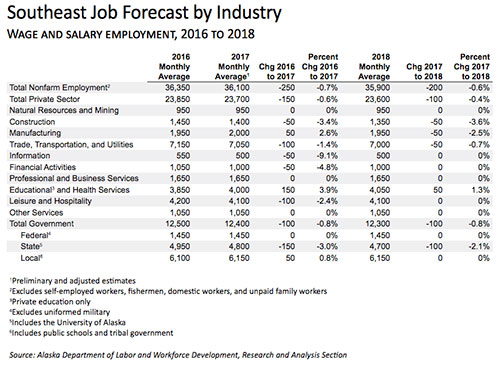

Alaska's Recession's second wave: Construction and professional services The second wave of job losses, reported by Wiebold, came from industries that depend heavily on the first two giants. When the oil and gas industry cut projects, construction employment began to fall. Similarly, when the state capital budget dropped, the construction industry absorbed much of the blow. Projects that were already funded continued, but the last couple of capital budgets have been bare bones, which has meant less construction work. Construction losses are forecasted to continue in 2018, at 500 fewer jobs. Alaska's Recession's third wave: Industries that rely on people’s spending Substantial upstream losses eventually reached the industries that depend on local demand and expendable income. Job loss in a local or state economy means less spending, which affects employers such as shopping centers, theaters, nonprofits that depend on donations, and bars and restaurants, wrote Wiebold. Retail trade, which lost 500 jobs statewide in 2017 and 200 in 2016, is expected to lose another 200 jobs in 2018 as consumers spend more cautiously. Southeast Employment to Decline Southeast Alaska’s employment is forecasted by Wiebold to decline slightly less in 2018 than it did in 2017. This year’s forecasted loss is 200 jobs, or 0.6 percent, which is on par with the statewide outlook for 2018. Southeast lost 250 jobs in 2017. The region underperformed the state as a whole over most of the last decade reported Wiebold. Southeast lost a greater share of its jobs in 2009 — the only year Alaska lost jobs during the national recession — and regained fewer in the years that followed.

Southeast began to lose jobs with the rest of the state in 2015, when oil revenue’s quick decline spurred state government job loss and steep cuts to the capital budget caused construction losses shortly thereafter, according to Wiebold. Other sectors of the region’s economy, such as retail, are now feeling the effects of the early job losses. Weakness in state government affects Southeast Alaska more than the rest of the state, reported Wiebold, but the region has almost none of the oil and gas employment that has been Alaska’s biggest source of loss. Southeast also has more of a buffer through tourism than other regions, which will further temper its losses.

Net migration, older population drive population losses In regards to the state as a whole, more people left Southeast than moved in between 2015 and 2016, according to Wiebold. This marked the fourth year of net migration losses for both, but while the state still gained overall population through natural increase (births minus deaths), that wasn’t large enough in Southeast to offset net migration losses. Southeast lost total population in both 2015 and 2016 - the only years of overall loss since 2007, when the region’s net migration bottomed out at -1,697, reported Wiebold. Wiebold reported that Southeast lost more than 800 people to net migration in 2016, and while natural increase offset some of that loss, these components of change affect different parts of the population. Net migration losses mean fewer workers and less local spending because households that move tend to have at least one working-age adult, while births and deaths are concentrated at age extremes. Net migration losses are likely to continue statewide with the current recession, particularly because the Lower 48’s economy is relatively healthy and the U.S. unemployment rate is at its lowest level since late 2000, wrote Wiebold. The Southeast region is also older than the state overall, according to Wiebold's report. Southeast’s largest age group is between 55 and 59, and the next-largest age groups are those that bracket it: 50 to 54 and 60 to 64. Many baby boomers arrived when Alaska was awash in oil money during the late 1970s and early 1980s, and they will continue to age out of the workforce in the near future. Most job loss in Southeast will be in government Southeast lost more than 700 state government jobs between 2014 and 2017 and is forecasted to lose another 100 jobs in 2018, reported Wiebold. (See Exhibit 3.) Cuts will likely slow in 2018 because savings opportunities will be harder to find after three years of cuts. While layoffs remain possible, most state government losses will continue to come from attrition in 2018, Wiebold forecasted. Baby boomers are still reaching retirement age, and many of their positions will be eliminated or left vacant. Federal government employment has been flat for the past few years, and that trend is forecasted to continue in 2018, according to Wiebold's economic assessment. Local government in Southeast, which includes tribal government, added 50 jobs in 2017 despite steep declines in state funding, and its employment is forecasted to remain at that level in 2018. Fish harvest lower than last year Commercial fishing is a significant part of Southeast’s economy, but seafood harvesting jobs aren’t part of this forecast Wiebold wrote because harvesters are considered selfemployed. Still harvests drive seafood processing employment, which is the bulk of the area’s manufacturing industry. Pink salmon make up most of Southeast’s commercial salmon harvest. Last year’s run came in lower than expected but still higher than the year before, and manufacturing added 50 jobs in 2017. According to the Alaska Department of Fish and Game, even years tend to have smaller runs, and the 2018 pink forecast is about two-thirds of 2017’s catch. As a result, manufacturing is expected to lose 50 jobs in 2018. Construction to continue decline in Southeast The next state capital budget will go into effect July 1, and while that budget won’t be final for a while, another low year is all but certain, reported Wiebold. The Southeast construction industry hasn’t yet sustained the full impact of the budget cuts because past funding from larger budgets has carried over, but that pool is diminishing. Although legacy projects are wrapping up, a handful of projects funded by the 2018 capital budget will boost job counts, including $4 million in improvements to the Alaska Permanent Fund headquarters in Juneau, $2.5 million for Hoonah cruise ship docks, and $2 million for Ketchikan’s cruise ship berths. Federal transportation funding will remain strong, with three years remaining of the generous Fixing America’s Surface Transportation Act. Federal funding won’t be enough to counter minimal state funding, though, so the industry is forecasted to lose 50 jobs in 2018, according to Wiebold. Tourism will boost some Southeast industries Though decreased economic activity puts a dent in locals’ spending in Southeast, summer tourism will remain strong as long as U.S. and international economies are growing, reported Wiebold. Southeast had more than a million cruise ship visitors in 2017, and 2018 is anticipated to be even better. Tourism is bigger in Southeast than the state as a whole, and it will shield restaurants and stores from the drop in business anticipated elsewhere, according to Wiebold's employment forecast. Employment in the trade, transportation, and utilities sector, which depends on tourism as well as local consumption, declined by 100 in 2017 and is forecasted to decrease by another 50 this year. While a strong tourism season will boost retail and transportation employers, declining local incomes will reduce demand during the rest of the year and offset visitor-related gains, she wrote. Leisure and hospitality, which is heavily tourism-based in Southeast, is forecasted by Wiebold to hold steady in 2018 after losing 100 jobs last year. While restaurants and bars will perform worse in the off-season due to less local spending, visitor spending on everything from tours to hotels will probably be enough to keep the industry stable. Other private Southeast Alaska industries The education and health services sector includes private health care and social assistance as well as private education, although Southeast has little of the latter. Private health care in Southeast has historically under-performed the state as a whole, partly due to the region’s recent economic woes, but it grew in 2017 and is likely to grow again in 2018. Growth is also likely in the long term, mostly to serve the region’s aging population, reported Wiebold. Southeast mining employment is forecasted to hold steady through existing mines and contractors. Exploration employment is minimal, and no potential sites are expected to open in the near future.

On the Web:

Representations of fact and opinions in comments posted are solely those of the individual posters and do not represent the opinions of Sitnews.

|

||||||