Life's basic necessities: food, clothing, housing... the federal government

April 28, 2016

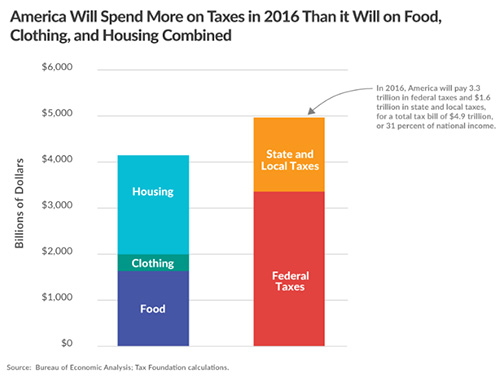

Chart courtesy Tax Foundation This year, 2016, Tax Freedom Day fell on April 24th, or 114 days into the year (excluding Leap Day). Tax Freedom Day® is the day when the nation as a whole has earned enough money to pay its total tax bill for the year. Tax Freedom Day takes all federal, state, and local taxes and divides them by the nation’s income. In 2016, Americans will pay $3.34 trillion in federal taxes and $1.64 trillion in state and local taxes, for a total tax bill of $4.99 trillion, or 31 percent of the national income. In 2016, Americans will work the longest to pay their federal, state, and local individual income taxes (46 days). Payroll taxes will take 26 days to pay, followed by sales and excise taxes (15 days), corporate income taxes (nine days), and property taxes (11 days). The remaining seven days are spent paying estate and inheritance taxes, customs duties, and other taxes. Each state's Tax Freedom Day is the day when taxpayers in the state have collectively earned enough money to pay their federal, state and local tax bill for the year. The total tax burden borne by residents of different states varies considerably due to differing state tax policies and the progressivity of the federal tax system. This means a combination of higher-income and higher-tax states celebrate Tax Freedom Day later: Connecticut (May 21), New Jersey (May 12), and New York (May 11). Residents of Mississippi will bear the lowest average tax burden in 2016, with Tax Freedom Day arriving for them on April 5. Also early are Tennessee (April 6), Louisiana (April 7) and Alaska (April 10). Forty-three states levy individual income taxes. Forty-one states tax wage and salary income, while two states - New Hampshire and Tennessee - exclusively tax dividend and interest income. Seven states, including Alaska, currently levy no state income tax at all. Methodology The Tax Foundation counts every dollar that is officially part of net national income according to the U.S. Department of Commerce’s Bureau of Economic Analysis. In the numerator, the Tax Foundation counts every payment to the government that is officially considered a tax. Taxes at all levels of government - federal, state, and local - are included in the calculation. Since 1937, the Tax Foundation's research, analysis, and experts have informed smarter tax policy at the federal, state, and local levels. The Tax Foundation notes that while taxes are a part of life, taxes don’t need to be burdensome and complex, nor inhibit economic growth. An ideal tax code, according to the Tax Foundation, is one that follows the principles of sound tax policy: simplicity, neutrality, transparency, and stability. On the Web:

Edited by Mary Kauffman, SitNews

Source of News:

Representations of fact and opinions in comments posted below are solely those of the individual posters and do not represent the opinions of Sitnews.

|

||