|

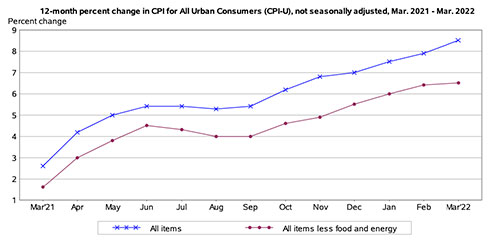

12 Month Percent Change in CPI for all Urban Consumers, not seasonally adjusted March 2021-March2022 |

In response to the release of the report, U.S. Senator Lisa Murkowski (R-AK) released a statement writing, “The numbers in this report serve to underscore the painful reality that Alaskans are facing every time they go to a grocery store or a gas station. Just about everything is being impacted by rising inflation as we see the cost of transportation and the overall cost of living punish families and businesses across our state."

“In rural parts of Alaska, the impacts are even more dramatic. In Noatak, people are paying almost $18 for a gallon of gasoline. In Point Hope, families are paying up to $8 for a loaf of bread and $3.39 for a quart of milk. These are real impacts that can be financially crippling," wrote Murkowski.

Murkowski demanded a comprehensive response from the Biden administration writing, “What we are seeing demands a comprehensive response from the Biden administration, the Federal Reserve, and policymakers. As part of that, we need to focus on supply chains and increase the domestic supply of a wide range of resources - starting with energy, which rose by 11 percent over the past month alone - and extending to minerals, which form the basis for just about every product in our modern society.

“Alaska is uniquely positioned to help, if only the Biden administration would allow us to do so. We can produce more oil, to ease pain at the pump. We can build a gas-line, to add billions of cubic feet to world markets each day. We can produce graphite, cobalt, and many additional minerals to help restrain rising commodity prices. And we can do all this without compromising environmental standards and continuing to reduce emissions," Murkowski wrote.

In conclusion Murkowski wrote, “Resource producers in Alaska are ready to work. It’s time for the Biden administration to unleash our potential to help reduce inflation. At this point, there’s simply no substitute and no excuse for not doing so.”

In a press briefing held April 12th aboard Air Force One En Route to Des Moines,, President Biden's press secretary Jen Psaki who speaks on his behalf, responded to a question asking: "Jen, you just mentioned that 70 percent of the CPI increase was gasoline related. We saw prices go up for housing, men’s clothing, airfare - food — you know, transportation, and all sorts of things. I’m just wondering if — what in this report has the White House convinced that inflation isn’t being embedded into the economy going forward?"

MS. PSAKI:

Well, I would say that the projections con- –from the Federal Reserve and other outside economists continue to be that inflation will moderate by year end. But we are not going to wait for that. And that is one of the reasons that the President is going to continue to take steps.

One step he’s taking, of course, today, which is to lower the cost of gasoline by — by announcing the EPA waivers that E15 can be available at 2,300 gas stations across the country.

But beyond that, he’s obviously taken steps to release a historic amount from the Strategic Petroleum Reserve. And we’ve continued to advocate for actions Congress can take to lower costs for Americans.

And if you look at how all of those costs impact Americans, we know that big, big costs — our childcare, healthcare, eldercare — these are all areas where the President has proposed a plan to reduce costs, and certainly it’s reminder of the importance of moving forward with that.

Press Question: "Jen, on the fuel waivers, the EPA’s own guidance says specifically that these waivers aren’t supposed to be used for relieving high gas prices. Some critics are also pointing to the fact that you’re declaring an emergency in June; we’re sitting in April right now. Can you kind of talk through why we’re taking some unprecedented steps or using some unprecedented justifications for this waiver?"

MS. PSAKI:

Press Question: "So how concerned is the White House that people are going to see that 8.5 percent sort of roll back their spending and then drive us into a recession?"Well, we’ve seen gas prices go up anywhere from 80 cents to a dollar since the — since President Putin invaded Ukraine. And that is certainly having a significant impact on the pocketbooks of Americans across the country.

And so, there are a range of reasons to take this step — and, of course, that the EPA is taking this step. But certainly, the fact that, right now, without this step, 2,3000 gas stations would essentially have a cover over the E15 gas pumps, not allowing people to utilize gas that is less expensive and not allowing additional supply to get into the marketplace.

So, at this moment where, obviously, we have a foreign dictator invading another country, we want to give ourselves additional flexibility and also do whatever we can do reduce costs for the American people.

MS. PSAKI:

"Well, I would also say that core CPI did go down this month. I don’t want to over-crank that, but that is certainly also data we look at.

And we noted that - our expectation about headline CPI - so that the American people, through all of you and whatever way you chose to report it, would understand we expected it to be elevated because of Putin’s invasion; because of the impact on energy prices, which they’re certainly experiencing every day.

So, I don’t have a projection on consumer spending at this point in time. Obviously, that data is taken by economists, but we wanted to provide as much information as we could assess about what we thought the data would show based on what people are already experiencing when they go to the gas pumps.

The CPIs are based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living. The March 2022 Consumer Price Index reported the 'all items index' continued to accelerate.

In other areas of the latest CPI report summarized by SitNews:

Food:

The food at home index rose 10.0 percent over the last 12 months, the largest 12-month increase since the period ending March 1981. The index for meats, poultry, fish, and eggs increased 13.7 percent over the last year as the index for beef rose 16.0 percent. The other major grocery store food group indexes also rose over the past year, with increases ranging from 7.0 percent (dairy and related products) to 10.3 percent (other food at home).

Energy:

The gasoline index rose 18.3 percent in March and accounted for over half of the all items monthly increase; other energy component indexes also increased.

The energy index rose 32.0 percent over the past 12 months with all major energy component indexes increasing. The index for gasoline rose 48.0 percent over the last year and the index for natural gas rose 21.6 percent. The index for electricity rose 11.1 percent for the 12 months ending March.

All items less food and energy

The index for all items less food and energy rose 0.3 percent in March. The shelter index increased 0.5 percent in March and accounted for nearly two thirds of the monthly increase in the all items less food and energy index. The rent index increased 0.4 percent in March as did the owners’ equivalent rent index. The index for lodging away from home rose 3.3 percent over the month after rising 2.2 percent in February.

The index for airline fares rose 10.7 percent in March, after rising 5.2 percent in February. The household furnishings and operations index rose 1.0 percent over the month, the eighth consecutive increase in that index. The index for motor vehicle insurance increased 0.7 percent in March, and the index for apparel rose 0.6 percent in March. The index for recreation increased 0.2 percent, and the index for personal care increased 0.5 percent over the month.

The medical care index increased 0.5 percent in March. The index for physicians’ services also increased 0.5 percent over the month, while the index for hospital services rose 0.4 percent. The index for prescription drugs fell 0.2 percent in March, after rising 0.3 percent in February.

The index for new vehicles increased 0.2 percent in March after rising 0.3 percent the previous month. The index for used cars and trucks fell 3.8 percent in March, its second consecutive monthly decline after a series of large increases. The index for communication was also among those few indexes which declined over the month, falling 0.5 percent.

The index for all items less food and energy rose 6.5 percent over the past 12 months, with virtually all of its major component indexes rising over the span. The shelter index rose 5.0 percent over the last 12 months, its largest 12-month increase since May 1991. The index for household furnishings and operations increased 10.1 percent over the past year, its largest 12-month increase since the period ending July 1975.

Brief explanation of the CPI:

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers. The all urban consumer group represents about 93 percent of the total U.S. population. It is based on the expenditures of almost all residents of urban or metropolitan areas, including professionals, the self-employed, the poor, the unemployed, and retired people, as well as urban wage earners and clerical workers. Not included in the CPI are the spending patterns of people living in rural non-metropolitan areas, farming families, people in the Armed Forces, and those in institutions, such as prisons and mental hospitals.

On the Web:

Download and read the full Consumer Price Index - March 2022 (pdf)

Consumer Price Index - February 2022

Source of News:

U.S. Dept of Labor - Bureau of Labor Statistics

www.bls.govOffice of U.S. Sen. Lisa Murkowski

www.murkowski.senate.govWhite House Briefings

https://www.whitehouse.gov/briefing-room/press-briefings/

Representations of fact and opinions in comments posted are solely those of the individual posters and do not represent the opinions of Sitnews.

Send a letter to the editor@sitnews.us

SitNews ©2022

Stories In The News

Ketchikan, Alaska

Articles & photographs that appear in SitNews are considered protected by copyright and may not be reprinted without written permission from and payment of any required fees to the proper freelance writers and subscription services.

E-mail your news & photos to editor@sitnews.us

Photographers choosing to submit photographs for publication to SitNews are in doing so granting their permission for publication and for archiving. SitNews does not sell photographs. All requests for purchasing a photograph will be emailed to the photographer.