Alaska's fiscal situationBy Rodney Dial June 09, 2017

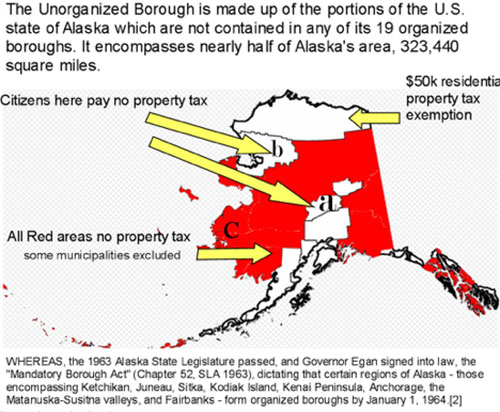

The skipper on the boat, Captain Walker, directs his executive officer Ortiz, to handle the problem without affecting the first class passengers in the middle. In response XO Ortiz yells at those rowing…. “Row harder, we’re sinking! and while you are at it, start bailing out the boat!” Having their hands full, those rowing ask XO Ortiz to have the first class passengers help, saying “If everyone helps our chances of survival will be better!”...Ortiz ignores them. The workers then plead…. “Well, can you at least stop letting new first class passengers in? the boat can’t support the additional weight!” Ortiz relays the request to the skipper, but it falls on deaf ears. The skipper has already agreed to take on numerous additional passengers (Medicaid expansion/Lifetime welfare)…. It’s all about the money he says. Those keeping the ship afloat and moving are asked to do more, while the passengers doing nothing continue to do nothing while their numbers increase. How long does this boat stay afloat? Simplistic analogy, but relevant to our state fiscal situation. You are witness to the greatest deception in this state since statehood. The state narratives, spoon fed to the public, are misleading and false. Program spending is not being reduced (reductions are in most cases simply deferrals to future years), state entitlement costs are skyrocketing and the plan you are witnessing intends to make those paying now… pay more… so that those currently paying nothing, can continue to pay nothing. You elected me as a borough assembly person to represent you and that is what I am trying to do. I was a state employee for nearly 26 years, including 10 years of service to the legislature. I’ve seen what is happening first hand and I am respectfully telling you that if you live in Ketchikan, Saxman, or in another incorporated area in Alaska, you are being treated unfairly and are about to shoulder an even greater and disproportional share of the cost of government. The following map helps explain this issue. With the exception of a few municipalities, the red areas and those listed as “a” and “b” on the following map represent the regions of the state that pay no property tax and have most and in some cases all services provided for free by the state. We are the only state in the country that allows the private ownership of land in rural areas tax free.

When pressed on why the State allows tax free living while providing no cost services to these areas, the official narrative has always been to “imply” that these areas are “too poor to contribute”. The truth is that many of the areas that pay nothing are the richest areas in the state. Consider the following examples: The Denali Borough, (a) which surrounds the national park, was formed to take advantage of tourism. This area has literally sprung up from nothing over the last 20 years. Currently multi-million dollar lodges, commercial buildings, national corporations and others operate in this area. The citizens in this borough (85% white) have officially the highest income in the state and are listed as the 63rd highest income per capita in the U.S. So my question to those reading this…. Why do wealthy companies and millionaires in this region deserve to pay ZERO property taxes and nothing towards education, while an elder on our island is forced by the state to pay mandatory property taxes? (Currently the entire Ketchikan borough property tax supports education as required by the state). See for yourself:

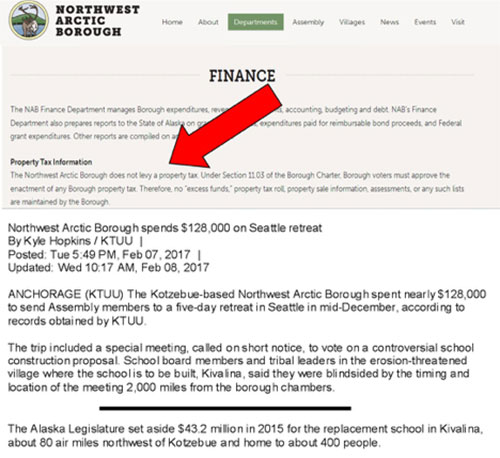

In the Northwest Arctic Borough (b) which serves approximately 7700 residents, also pays no property tax. In this area their borough just signed an agreement (PILT Payment in Lieu of Taxes) with a single mine (Red Dog) that will provide them with a quarter of a BILLION dollars, (over $32 thousand per citizen!). This borough has so much money they recently sent their entire borough assembly to Seattle for a meeting at a cost of $128,000. So my questions to you are:

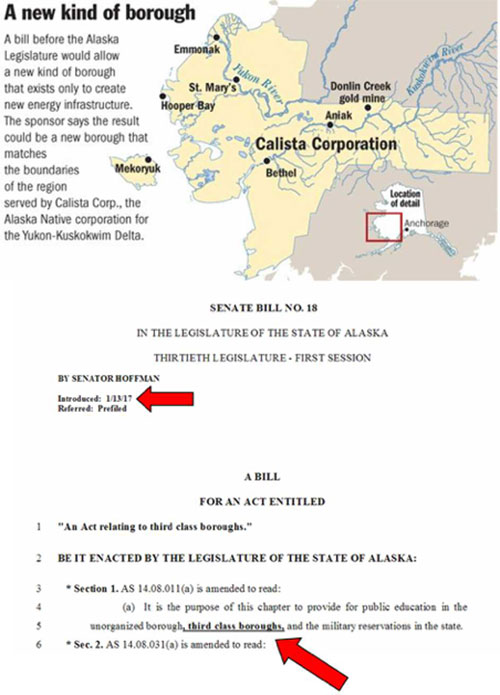

Want another example?... In the Bethel Y/K census area, this region which contains Alaska’s eighth largest city also pays no property taxes and has most services provided for free from the state to include lifetime welfare. The representative from this region has introduced legislation that would allow them to obtain the benefits of borough formation without the tax consequences of borough formation. Essentially, they want to form a special borough that can tax industry while allowing citizens to live for free, pay no property taxes and have the state supply their services including education.

If that were not enough examples for you, we could talk about the vast tax free area outside Anchorage/Palmer in the Glennallen area, the tax free areas on Prince of Wales, etc, etc. Sad bottom line is that if you live in Ketchikan/Saxman you are quite simply being screwed and Dan Ortiz could care less. Not only are you paying 100% more taxes than many regions…some of which are far wealthier than Ketchikan… the state is MANDATING that you pay even more and our Rep. Dan Ortiz is actually working to make this happen! Ask yourself the following questions: Q. Why are the communities worried about the state budget and worried about laying off teachers all from incorporated areas like Ketchikan? A. Because Governor Walkers and Rep. Ortiz’s plan is to have the areas that pay now… pay more… so that the areas paying nothing, can continue to pay nothing. Half the state has all educations costs provided for free and will continue to under the Governor’s plan. Education cuts will only affect areas like Ketchikan that are mandated by the state to pay property taxes for education. Q. How much has been cut from the state’s welfare (TANF) program that provides lifetime welfare in 162 locations? A. Zero cuts… entitlement spending is INCREASING and the budget for DHSS is now over $2.5 billion annually. Q. Rep. Ortiz continues to claim he has helped cut the budget, is this true? A. No. Rep. Ortiz voted against hundreds of ideas to reduce spending, including the infamous legislative lounge. How many have heard Rep. Ortiz claim he supports legislation to reduce the nearly $250 a day perdiem legislators receive? (Including those who live in Juneau). You do realize what he is failing to mention is that perdiem must be claimed by the individual. They could cut their perdiem today if they wanted to by simply claiming less, but they won’t and are trying to mislead you by “saying” that they support legislation to reduce perdiem, that they have no intention of passing. Q. Several weeks ago Rep. Ortiz held a town hall where he brought the Governor’s Budget Director along to discuss the number of state employee positions reduced since the start of the budget crisis. They claimed thousands of fewer state employees; is this true? A. No, those that attended this town hall remember that they tried to imply that government has been reduced significantly and stated thousands of fewer “state positions” but when confronted about their claim during public comment, by me, they eventually admitted only 77 layoffs. Great example of how Rep. Ortiz is intentionally trying to mislead you. Here is how this works… State Agencies have “x” number of FUNDED positions, which is different from FILLED positions. Agencies maintain vacancies to pad their budget each year. Some funded positions have never been filled, such as in the VPSO program. What Governor Walker and Rep. Ortiz did was to eliminate on paper the vacant positions while allowing the various departments to keep the funding. This gives the appearance of a reduction when there is none. Numerous amendments were proposed by other representatives this year to return funding for the vacant positions to the state, but Rep. Ortiz voted against ALL attempts to do this. Smoke and mirrors friends. This leads to the basic question that if these departments can do without these positions and maintain vacancies, then why are we funding this many positions in the first place? What is really happening is that Rep. Ortiz and his caucus are simply not letting a crisis go to waste. They FULLY realize that an income tax is not needed at this time and that is why under their plan implementation of an income tax is delayed more than a year until AFTER the next election. The Senate plan which includes no income tax, comes so close to closing the deficit that existing savings will last at least a decade before new taxes are needed. So why risk making a recession worse by imposing an income tax? Well simply because they know that by next year they will not be able to hide from the public that an income tax is unnecessary. Is all about INCREASING spending. Don’t forget that an income tax requires government to grow by an estimated 60-120 new state employees. The issue of state tax fairness is not a partisan issue. Ketchikan/Saxman citizens of all political persuasions should expect and demand that areas of the state that can contribute… like we do… contribute, so that the burden on all Alaskans is as fair as possible. The Ketchikan Gateway borough realizes this need and recently voted unanimously in support of a resolution, given to Rep. Ortiz, demanding parity and fairness in taxation. Not only has Rep. Ortiz refused to represent us and demand fair treatment… he is actually working against us and has aligned with special interests. His caucus has refused to negotiate and is currently demanding an income tax or they will shut down government. The following picture speaks a thousand arrogant words.

Friends, please question what Rep. Ortiz is feeding you, because he is not working in your best interest and the proof, should he be successful, will be the never-ending tax increases that follow. Rodney Dial About: Rodney Dial is not speaking on behalf of the Ketchikan Borough Assembly of which he is a member. This letter represents his personal opinion.

Received June 08, 2017 - Published June 09, 2017

Viewpoints - Opinion Letters:

Representations of fact and opinions in letters are solely those of the author. E-mail your letters

& opinions to editor@sitnews.us Published letters become the property of SitNews.

|

|||||||