RE: Fact versus fictionBy Rodney Dial July 19, 2017

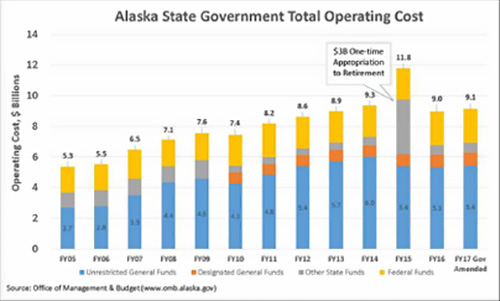

Rep. Ortiz wrote… Since I entered office in January 2015, we have cut the operating budget by approximately 44 percent. These cuts are not deferrals on payments to future years. We have ended countless programs, there are 2,500 less state employees than there were in 2014, and there were direct pink slip non-retention notices given to 77 employees. In the process the different state agencies heaped more responsibility on remaining state employees as their coworkers retired or moved to the private sector and those vacant positions stay unfilled. My reply: Dan likes to compare various funds, and not total state spending. This is misleading because his caucus moves money from one fund to another to give the appearance that spending is being reduced. Truth is Dan recently voted for the second largest budget in State history, voted against hundreds of ideas to reduce spending and wouldn’t even vote to cut the legislative personal chef. Additionally, most of the budget reductions Dan claims are in fact deferrals. Gov. Bill Walker has vetoed hundreds of millions in oil tax credit payments over the last few years which gives the appearance of reduced spending. This is a state debt which we still owe and must pay; we can only end future unearned payments. State oil tax credit payments were also shorted again this year and we now owe more than $1billion. This gives the appearance that spending has been reduced when it hasn’t. This is a deferral! Most of the other reductions were made to capital spending. Capital spending is for schools, infrastructure, etc. Unless you believe the “need” has gone away, a cut one year only means an increase in a future year, and unfortunately these things tend to cost more over time. The reduced state employee counts are smoke and mirrors. First, the only reason Dan mentioned the “77 layoffs” in his letter is because I showed up at his town hall, and publically pressed Gov. Walker's budget director (who was there) for the number. Prior to that Dan was simply claiming thousands of fewer state employees. In my previous letters I explained how they play this game. They eliminate on paper the vacant positions state departments have always used to pad their budgets. The difference is between positions funded and positions filled. The State department I worked for since the 80’s, maintained a vacancy rate for my entire career. Dan voted against numerous attempts this year to return money for the unfilled state positions to the treasury. Additionally, the SOA has outsourced some of these positions to other governmental bodies to give the appearance of reduced state employee counts, however we still pay for the positions and in many cases, an extra premium on top, called an indirect, for the outside administration of the position. I helped manage this as a state employee and saw indirect rates exceeding 25% above the cost of the program (reason why a VPSO costs more than a Trooper).

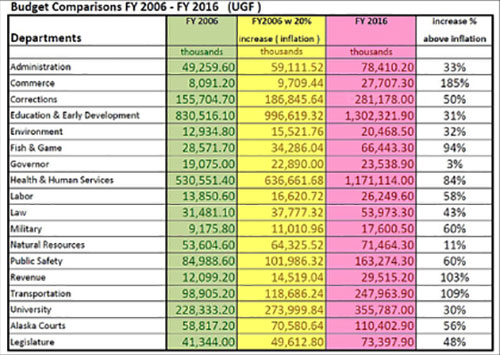

Finally, Dan likes to claim cuts to agencies, but fails to mention the increases to those same agencies. A great example is how Dan supported state employee raises during the last few years that have added tens of millions to the state budget annually. Kind of like buying a new car with a $500 a month payment, then telling your spouse you are saving money because you eliminated your $100 cable bill. Does anyone reading this letter actually believe there will be fewer state employees the moment people like Dan get an income tax?... not a chance!

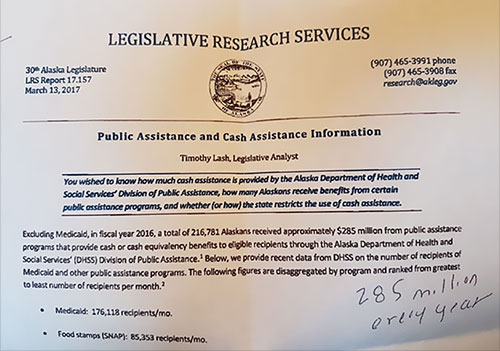

NOTE: The final budget passed by the House Majority (Ortiz voted yes) was $11 billion! Even higher than reflected on the chart above, and second highest ever for Alaska. For more information see http://www.sitnews.us/0617News/061517/061517_alaska_budget.html Dan says… MYTH: State entitlement costs are skyrocketing, and there are Alaskans on lifetime welfare. (Dan’s alternative FACT): These costs have been reduced - that’s not always good for us. Reductions in assistance for poor working families, vulnerable children, seniors, and the disabled strain our communities and their economies. I have worked to insulate senior, disability and Day Habilitation services from drastic reductions proposed by others in the Legislature, but some cuts have been made. There is no such program as lifetime welfare. All programs have a capped time period, with a reasonable allowance for Temporary Assistance for Needy Families extension if parents are able to prove that they are employed at least part time, and actively pursuing more work. My reply… His statement is political babble and meant to mislead you. Friends, you have to pay attention to the key words he uses, for example: Dan says, “No such PROGRAM as lifetime welfare”… what Dan didn’t say is that people are not collecting welfare for life, because the actual fact is that thousands of Alaskans are, and have been for many years. As I mentioned in previous letters, Dan’s legislative staff helped me obtain the information, so for him to deny it, is pretty amazing. The program is officially known as Temporary Assistance for Needy Families (TANF), commonly known as welfare. In urban areas like Ketchikan, (and the rest of the U.S.) TANF is limited by Federal Law to 5 years in a person’s lifetime. However, in 162 regions of the state (50.47% of all Alaskan communities) there is no limit and people who reside there can collect welfare for….LIFE! I witnessed this first hand as a state employee during my career. Don’t take my word for it. Click on the following link which will take you to the State of Alaska web page, and read it for yourself. This is an official state document that lists all 162 Alaska communities in which residents are allowed to collect lifetime welfare (TANF). This is a monthly check given to them with NO TIME LIMITS. This is what Dan Ortiz wants you to pay an income tax to support. Read it and then decide for yourself if Dan is trying to fool you. This state document shows the 162 Alaska regions allowed to collect lifetime welfare. http://dpaweb.hss.state.ak.us/manuals/ta/addenda/addendum_1.htm This state document explains how the state determines which areas are exempt from welfare rules. http://dpaweb.hss.state.ak.us/manuals/ta/addenda/addendum_3.htm Regarding Dan’s assertion that state entitlement spending is not unsustainable, consider that the State department responsible for welfare and other entitlement spending, DHSS now spends approximately $2.5 billion in STATE FUNDS, $3385 per citizen, or nearly $8000 per working Alaskan…per year. I have a document (see below) from the legislative research office that I obtained earlier this year that showed that over 200,000 Alaskans collected welfare at some point in 2016. Alaska has become the state with the highest percentage of citizens on welfare in the country. When I was a trooper working in rural Alaska, I witnessed scores of people move to Alaska every year and take up residence in one of the 162 communities that are tax free AND allow individuals to collect welfare for life. People kicked off of public assistance in the lower 48 due to time limits, quickly learn that they can move to Alaska and collect some of the highest cash payments in the nation…forever! In addition, anyone on welfare would additionally qualify for Medicaid…a program that costs the state nearly $700 million per year and is projected to cost over $1 billion annually soon.

MYTH: The required financial contribution of residents living in organized boroughs and municipalities to education can be eliminated. (DAN’s) FACT: With a significant financial investment, the Ketchikan Gateway Borough brought this issue all the way to the Alaska Supreme Court. I became convinced that the KGB had a solid argument as a basis for their case. Unfortunately the AK Supreme Court did not see it that way and the requirement was upheld. This session I put forth an amendment to a proposed bill that would have given a deduction of up to 50% of the amount of property tax an Alaskan resident paid who resided in an organized borough or community that is required to pay the 2.8 mill levy for state education costs. I am the only legislator in the history of this required contribution to have done so. Though the bill and amendment did not pass, while I’m office I pledge to continue to try and find ways to bring about parity and fairness on this issue. My reply… More political double speak from Dan. The issue is that approximately ½ of the State pays a mandatory tax (Ketchikan residents pay) for education and pay 100% of all school construction costs… while the other ½ of the State pays NOTHING and has ALL school construction costs provided for free. The closest examples would be Metlakatla and most of POW that have their schools funded at 100%, while Ketchikan residents are forced to pay millions per year. This cost is reflected in the price of everything in Ketchikan, rent, food, etc. and one of the reasons it is so expensive to live here. See my previous letter for more information. As far as Dan’s amendment, it was just for show. As part of the House Majority, 5 minutes of conversation with his caucus would have shown no support for his amendment; meaning he knew it would never pass (his fellow democrats voted no). Just a gimmick to placate those like myself and the Borough Assembly who have been demanding that he fight for fairness for our community. On a side note we also asked Dan to represent us regarding the Shipyard as the Walker administration decided that the Ketchikan Borough (taxpayers) now owe a tax liability on a facility OWNED by the State (AIDEA). So in essence, we are being taxed for property we don’t even own, while multi-billion dollar companies like the Red Dog mine near Kotzebue are tax free for their citizens. This is really the big issue regarding Dan; he is all about representing special interests and flat out refuses to demand fairness for our citizens. Dan says… MYTH: A representative introduced legislation to allow the Bethel census area to form a cost-free municipality (Dan’s )FACT: The legislator who introduced legislation to allow the Y/K census area to form a borough without the tax consequences of borough formation is a Senate Majority Caucus leadership member. My reply… It’s not a myth, it’s true, and I attached a copy of the legislation to my last letter as proof. Dan is just shifting blame for why his “political correctness” keeps him from demanding fair treatment for Ketchikan residents. Bottom line is that if Dan gets his tax increases to fund increased state spending many Alaskans will be priced out of living here. Please help us tell Dan that Ketchikan is not willing to pay more, so that other Alaskan communities can continue to pay nothing. Rodney Dial Note: The opinions expressed are my own and do not represent the opinions of the Ketchikan Borough Assembly of which I am a member. Received July 15, 2017 - Published July 19, 2017 Related:

Viewpoints - Opinion Letters:

Representations of fact and opinions in letters are solely those of the author. E-mail your letters

& opinions to editor@sitnews.us Published letters become the property of SitNews.

|

|||||