Alaska Faces Lower Oil Revenue with Lower Oil Price in Fall 2015 Forecast

December 09, 2015

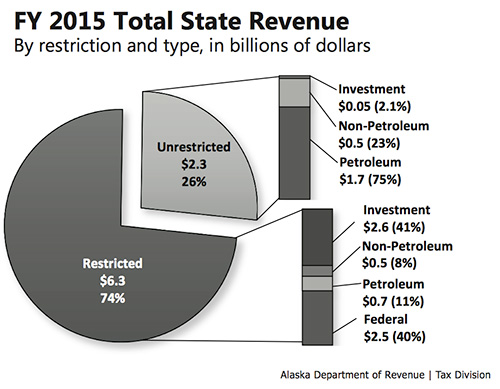

“The reality of our current fiscal condition is that total state revenues have dropped more than 50% from fiscal year 2014, and, of that total, general fund unrestricted revenues have declined nearly 60%,” Hoffbeck said. Total state revenue was $8.5 billion in fiscal year 2015 from all sources. Of that total, general fund unrestricted revenue (GFUR) totaled $2.3 billion with oil and gas revenues accounting for approximately 75% of all unrestricted revenue. Unrestricted revenues have also collapsed by over 50%. For comparison, in FY 2014, total state revenues were $17.2 billion and general fund unrestricted revenue totaled $5.4 billion. The Department of Revenue forecasts total revenue as $9.5 billion in FY 2016 and $10.3 billion in FY 2017. REVENUE SOURCES BOOK Fall 2015 The Fall 2015 revenue forecast is based on an annual average Alaska North Slope oil price of $49.58 per barrel for fiscal year 2016 and $56.24 per barrel for fiscal year 2017. “Beyond that, we project that annual average prices will slowly increase to more than the $80-per-barrel nominal price within the 10-year-forecast period, based on the analysis of the structure of oil markets,” Hoffbeck said. This year’s forecast introduces a new presentation of revenue available for current-year appropriation, in the Executive Summary of the Revenue Sources Book. Revenues available for current-year appropriation include, in addition to unrestricted and designated General Fund revenues, realized earnings of the Alaska Permanent Fund accounted for in the Earnings Reserve, earnings of the Constitutional Budget Reserve Fund, and other deposits. For fiscal year 2016, the Department is now forecasting $9.5 billion in total revenue and $1.6 billion in general fund unrestricted revenue (GFUR). For fiscal year 2017, the Department is forecasting $10.3 billion in total revenue and $1.8 billion in general fund unrestricted revenue (GFUR). Utilizing the new convention for the Revenue Sources Book that takes into account what is available for appropriation, there is expected to be about $5.4 billion in current-year revenue available for appropriation for FY 2016. For comparison, the state had $6.0 billion in current-year revenue available for appropriation in FY 2015. In addition to unrestricted revenue, “current-year revenue available for appropriation” also includes designated general fund revenue, as well as realized earnings of the Permanent Fund accounted for in the Earnings Reserve, earnings of the Constitutional Budget Reserve Fund, various royalty and tax deposits to the Constitutional Budget Reserve, and various royalty and tax deposits in excess of the constitutional minimum into the Permanent Fund. The basic data for the forecast is available on the Department’s website.

On the Web:

Edited by Mary Kauffman, SitNews

Source of News:

|

||