Alaska's Housing Market: The First Half of 2015

December 09, 2015

Wednesday AM

(SitNews) - There’s heightened interest in some of the state’s broad economic measures recently as a result of low oil prices and state budget challenges. Through the first half of 2015, Alaska housing prices and other housing market indicators showed no major signs of weakness according to Juneau-based Economist Karinne Wiebold.

In the December 2015 edition of Alaska Economic Trends, Wiebold reports the average sales price for a single-family home in Alaska increased 4 percent from the first half of 2014. But despite higher prices, housing affordability improved over that period. Statewide wages rose 3.5 percent, outpacing a 1.1 percent increase in inflation, and the average mortgage interest rate dropped a little over half a percentage point.

For more than two decades, the Alaska Department of Labor and Workforce Development’s Research and Analysis Section has worked with the Alaska Housing Finance Corporation to collect and analyze Alaska’s housing statistics, including residential loans, new construction, foreclosures, interest rates, and affordability.

What follows is a summary of the department's most recent findings.

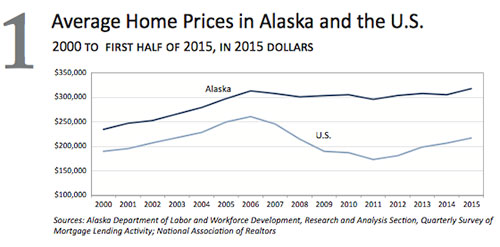

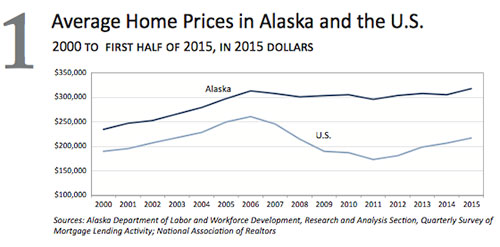

- While Alaska has historically been a more expensive place to buy, single-

family home prices tracked closely with the national average until 2006, after which Alaska’s prices dipped but generally maintained value while U.S. prices fell precipitously.

- The average sales price in the U.S. plunged by a third from 2006 to 2011. Alaska’s dipped by just 5.5 percent.

- In the first half of 2015, Alaska’s average single-family home cost 46 percent more than the national average.

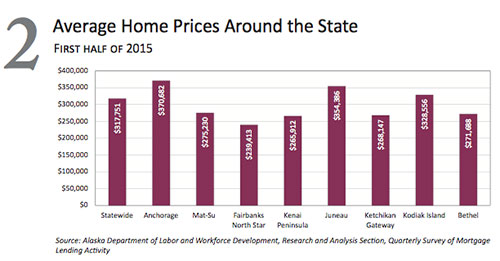

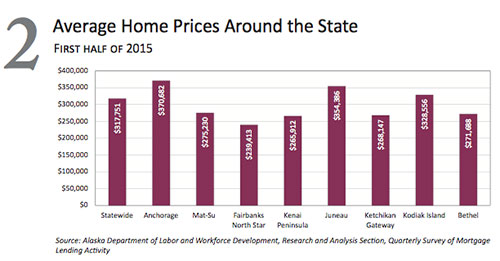

- Prices vary greatly around the state. The average home price statewide is $370,682. Ketchikan's average home price is $268,174.

- Juneau, Anchorage, and Kodiak are typically high priced markets, while Ketchikan, Mat-Su, Fairbanks, and Kenai tend to be lower priced.

- Single-family home prices in Fairbanks, the lowest of the surveyed areas in the first half of 2015, have been falling over the last couple years. At the same time, the area has lost some population and a small number of jobs.

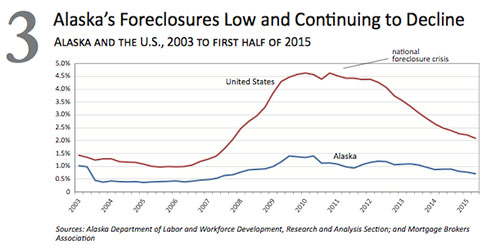

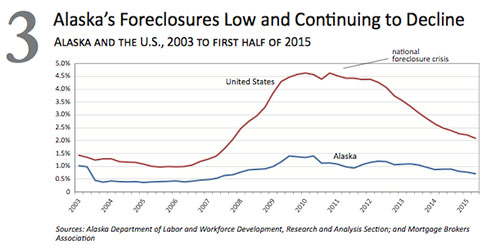

- While Alaska saw an increase in foreclosures in the wake of the national housing crisis, Alaska fared quite well in comparison due to less speculative building and more conservative lending, among other things.

- The current foreclosure rate in Alaska is roughly a third of the national rate, and both rates continue to fall as the economy recovers from the overheated housing market and national recession.

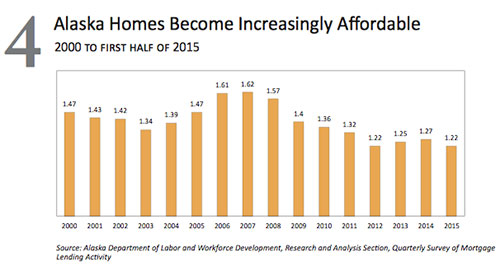

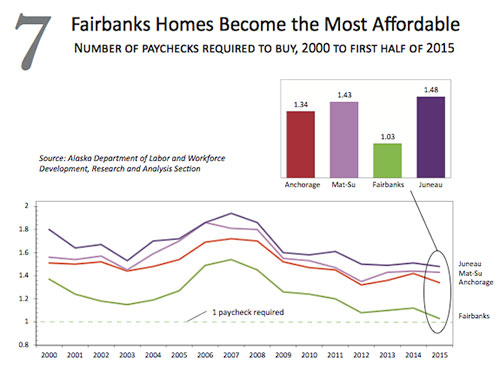

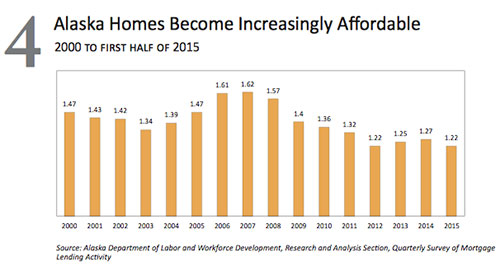

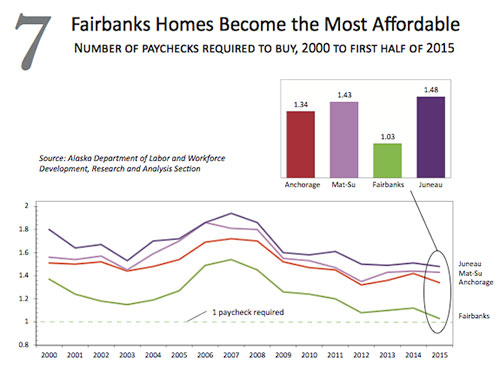

- The affordability index measures the number of average wage earners required to purchase a home (given the constraints outlined in the box above). Lower numbers indicate greater affordability.

- Purchasing homes in Alaska has become more affordable in the last several years, primarily due to his- torically low interest rates.

- According to the National Association of Realtors’ affordability index, housing nationwide has become less affordable this year compared to last, as the increase in single-family sales prices has only been partially offset by declining interest rates and modest gains in median incomes.

How the affordability index works

The Alaska Department of Labor and Workforce Devel- opment creates indexes to monitor housing affordability across Alaska. The indexes measure a number of eco- nomic housing factors and how they interact, producing a single value.

The Alaska Affordability Index considers sales prices, loan amounts, wages, and interest rates to estimate how many wage earners it would take to afford a 30-year fixed rate mortgage on an average priced home, given the average interest rate, wage, and loan amount and assuming 24 percent of the earner’s gross wages are available for mort- gage payments. Put another way, it tells you how many people have to bring in a paycheck to afford a home.

An index value of 1.0 means exactly one person’s average income is required to afford a typical home. An increasing number means additional income is necessary, making housing less affordable.

The index monitors housing affordability based only on factors the Department of Labor and Workforce Develop- ment measures on a regular basis. However, many other factors affect affordability, some of which are unique to households’ situations and would be difficult to measure consistently. These include:

-

Hazard insurance and mortgage insurance

-

Property taxes, which vary by area and property size

-

Utilities, which can be substantial and vary depending on energy type

-

Adjustable rate mortgages, where monthly payments can change dramatically based on interest rate shifts

|

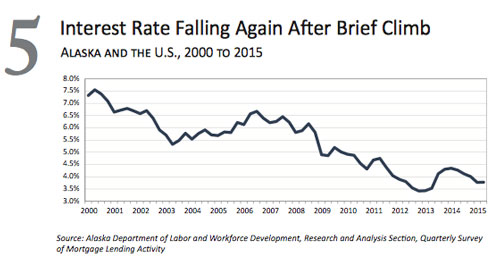

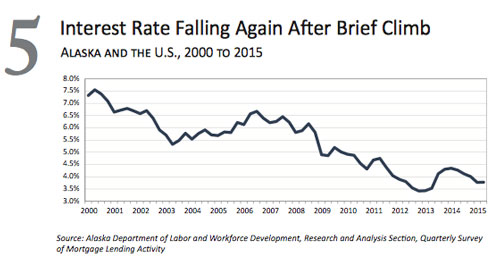

- Interest rates have a significant influence on affordability. For exam ple, a 4 percent interest rate rather than 5 percent saves a homebuyer $178 a month on a $300,000 home.

- The Federal Reserve has indicated they may begin to raise the bench mark interest rate (which has stayed between 0 and 0.25 percent for nearly six years) by the end of 2015 or early 2016, and when they do so, mortgage interest rates will likely rise.

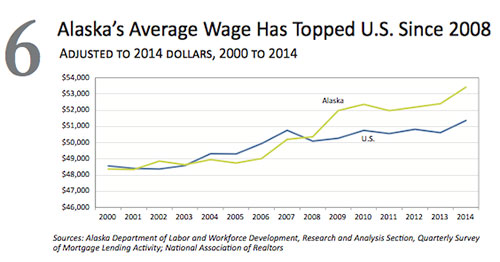

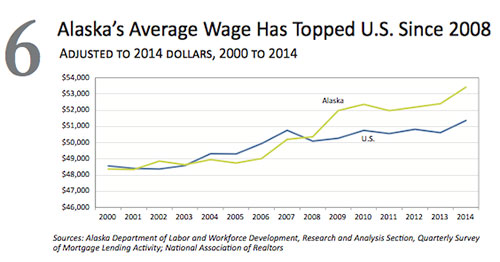

- Contrary to popular belief, Alaska has not always had higher average wages than the nation.

- After rising above and dipping below the national average in the early parts of the 2000s, Alaska’s average wage pulled ahead during the national recession of the past decade and continued to exceed national averages during the recovery period.

- Affordability depends on each area’s unique combination of sales price and wages.

- It might be surprising that Mat-Su is less affordable than Anchorage, because Anchorage is generally a more expensive place to live. Although Mat- Su homes are less expensive, Mat-Su wages are considerably lower than in Anchorage, resulting in a higher index value.

- Falling home prices make Fairbanks very affordable, requiring just over a single paycheck.

- From2006 to 2008, a combination of peak home prices and interest rates about 2.5 percentage points higher than in 2015 pushed the index value up in all areas, requiring much more than a single paycheck to afford the typical mortgage.

- Despite relatively high wages, high home prices in Juneau keep it less affordable than other areas.

On the Web:

December 2015 Alaska Economic Trends

http://www.labor.state.ak.us/trends/dec15.pdf

Karinne Wiebold [karinne.wiebold@alaska]

Edited by Mary Kauffman, SitNews

Source of News:

Alaska Department of Labor & Workforce Development

http://www.labor.state.ak.us

Publish A Letter in SitNews

Contact the Editor

SitNews ©2015

Stories In The News

Ketchikan, Alaska

|

Articles &

photographs that appear in SitNews may be protected by copyright

and may not be reprinted without written permission from and

payment of any required fees to the proper sources.

E-mail your news &

photos to editor@sitnews.us

Photographers choosing to submit photographs for publication to SitNews are in doing so granting their permission for publication and for archiving. SitNews does not sell photographs. All requests for purchasing a photograph will be emailed to the photographer.

|

|