|

Money Matters BABY BOOMERS WAKE-UP CALL

October 10, 2012

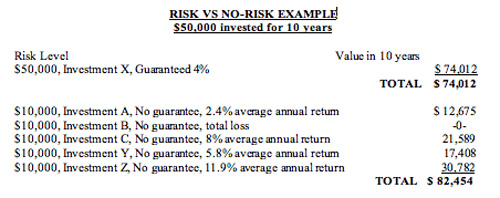

For an awful lot of those boomers, the research out there is downright depressing, because studies consistently show that 60% of workers 55 or older have less than $100,000 accumulated for retirement and 31% of those same workers have accumulated less than $10,000! At the same time, pensions are almost a thing of the past and Social Security may have to undergo some significant changes if it is to survive for the generation to follow the boomers. Unfortunately, of all workers surveyed, 64% answered that they believe that they are doing a good job of saving for retirement, but only 42% of those same workers have ever done any specific retirement planning. This apparent break from reality is disturbing, and indicates a major gap between understanding what is actually needed to retire and what is being saved/invested for exactly that same purpose. Most workers, if they save at all, are saving at a rate of about 3%, according to most studies. In fact, financial planners recommend savings rates of 10% for the younger set, going up to 20% in middle age, and 30% for anyone who has procrastinated clear into their 60’s. In addition, further studies show that at least half of retired people report that their spending did not drop during retirement as much as expected, with 50% of retirees surveyed saying that their expenses were either the same or actually went up after retirement. This may be due to uninsured medical bills, or to leisure activities like travel, but regardless of why, it shows a clear disconnect between expectations and reality. And to make things even worse, many employees who direct their own investments in a retirement plan choose those investments poorly. Some accept the default option, which may or may not be suitable. In fact, in some plans the default investment choice is cash, which earns almost nothing and declines in value (due to inflation) over time, rather than increasing in value as should be the goal. Also, there are lots of employees who are simply too conservative, because they want to avoid all risks associated with investing. What they do not realize, however, is that it is not possible to avoid all risks, because arriving at retirement with so little money accumulated results in working all your life just to end up almost broke…..and that’s the biggest risk of all. Risk is present in all types of investments, even the most conservative ones and, but it can be reduced by careful asset allocation and diversification…..not putting all of your financial eggs in one basket. See the example below for an illustration of this concept.

In the 28+ years that I have been a certified financial planner ™, I have never once had a client tell me that they wish that they had saved and invested less, or that they wish that had waited until later to get started on saving and investing for retirement. Never. It is clear that once you are actually facing retirement, and take an hour or so to figure out what your income will really be when you stop working, reality has a sneaky way of busting into the front of your mind, and for some, panic sets in. The easier way to do it is to start early, make a plan, stick with the plan, learn to be disciplined about giving up a little bit now for a lot of benefit later, and commit to the plan for the long haul. The earlier a worker starts, the more risk he or she can afford to take, the less money is required for each contribution to retirement and the better the chances for greater accumulation over time. For the young set, time is their best friend. For the man or woman facing retirement in less than 10 years, time is not such a kind friend, and risk is now not the generic term is was at age 25. For example, if a 25 year-old invests $5,000 per year at 7.2% for just 10 years, and then leaves the money invested, earning a continued average annual return of 7.2%, by age 65 he will accumulate a nest egg worth $598,072. However, if he waits until age 35 to start (same assumptions), he will only accumulate $299,036 by age 65 and if he procrastinates until age 45 to get started, his nest egg, assuming the same assumptions of average returns, will only be worth a paltry $149,518 by comparison. In each case, $5,000 was invested every year for 10 years, and each investor earned the same 7.2% average annual return, but the 25 year-old ended up with $448,554 more money just by starting at an earlier age. That’s the power of starting early! The reality check that many baby boomers are now experiencing is real. These numbers are real. Whatever your age, get started now. Every small sacrifice you make to save and invest today is nothing compared to waking up retired one morning and discovering that you have spent it all and are, in fact, broke.

On the Web:

Mary Lynne Dahl, CFP® is a Certified Financial Planner ™ and partner in Otter Creek Partners, a fee-only registered investment advisor firm in Ketchikan, Alaska. These articles are generic in nature, are accepted general guidelines for investment or financial planning and are for educational purposes only.

|

|||