Wells Fargo is a Bank, Not a Center for Political ActivismBy SUSAN STAMPER BROWN

September 14, 2016

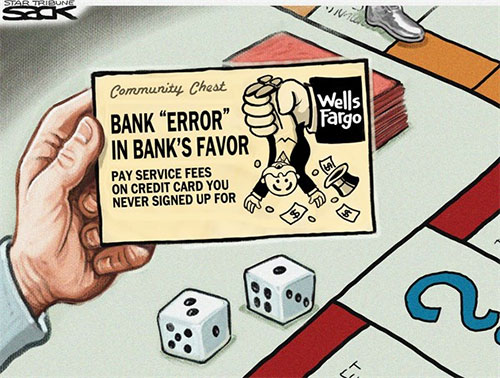

In a recent press release, the Consumer Financial Protection Bureau [CFPB] recounted that Wells Fargo Bank, N.A. will pay "the largest penalty the CFPB has ever imposed," $185 million, because thousands of Wells Fargo employees "covertly" opened "more than two million deposit and credit card accounts," transferring funds from consumers' authorized accounts without their knowledge or consent, often racking up fees or other charges."

Wells Fargo Scam

Specifically, approximately 5,300 employees may have opened roughly 1.5 million deposit accounts, transferring funds from consumers' accounts to temporarily fund the new, unauthorized accounts. The CFPB reports that consumers were "sometimes harmed" from insufficient funds or overdraft charges. But it seems it was a win-win for Wells Fargo for those actions apparently helped the bank meet sales goals and also helped employees earn additional compensation. Additionally, CFPB says employees applied for "roughly 565,000 credit card accounts that may not have been authorized by consumers, leading to "incurred annual fees, as well as associated finance or interest charges and other fees." They also issued and activated debit cards and created PIN numbers and fake email addresses to enroll unaware consumers in online-banking services. All this while Wells Fargo was simultaneously shoving social issues down consumers' throats, something they've done for years. Last year, in response to an advertisement featuring a lesbian couple, noteworthy Evangelicals like Franklin Graham said they'd had enough and closed out their accounts. Nonetheless, Wells Fargo remained resolute in its activist stance and has the right to do so. But individuals also have the right to put their money in banks that leave what people do in the bedroom out of the boardroom.

Wells Fargo Sales Tactics

Walking the talk? Sure, Wells Fargo repeatedly receives high rankings from the Human Rights Campaign, the largest LGBT advocacy group and political lobbying organization in the United States. But the bank's latest scam is just one more in a "string of infractions," reports USA Today.Wells Fargo "faced or settled four key areas of litigation as of the end of 2015" including FHA insurance claims, Visa and MasterCard interchange fees, mortgage products, and order of posting (overdraft) fees. So why not try walking the bank talk? Obviously, Wells Fargo has lost its focus. It is easy to do. But when a distraction sidetracks your purpose, something's got to give. Wells Fargo's forgotten that a bank is not a social experimentation petri dish. It is a financial institution...a bank. Banks lend and borrow money and accept customers' deposits and pay interest in return. Then they use those funds to lend to other customers. Pure and simple. Given that 5,300 employees, not just a handful of bad actors, were fired for what boils down to identity theft for profit, Wells Fargo would be better served serving its purpose, rather than investing time and energy bartering in social and political activism.

Susan Stamper Brown Susan's is a recovering political pundit from Alaska, who does her best to make sense of current day events using her faith. Her columns are syndicated by CagleCartoons.com. E-mail Susan at: writestamper@gmail.com. ©2016 Susan Stamper Brown. Susan’s column is distributed exclusively by: Cagle Cartoons, Inc., newspaper syndicate.

Representations of fact and opinions in comments posted below are solely those of the individual posters and do not represent the opinions of Sitnews.

|

||