Income Tax 101By TOM PURCELL March 21, 2013

You're probably wondering why you have to spend a couple of weekends barricaded in a room, sorting through receipts in the faint hope of complying with our confusing income tax laws. The income tax first came to America in 1861. Americans paid it to help finance the Civil War, but come 1871 — six years after the war — the tax was repealed. Some politicians, however, took a liking to it. They tried for the next 20 years to reinstate it. But the Supreme Court shot down the income tax as unconstitutional.

Tax day hari kari

Here's how it worked: Only those who earned more than $3,000 — a lot of money in those days — had to pay. And they only had to pay about 1 percent. The highest rate, for those who earned $500,000 or more, was only 7 percent. As you well know, these low tax rates didn't last. By 1918, the top rate — the highest rate imposed on the highest earners — rose to a whopping 77 percent. Why? So America could finance World War I. And did the rates drop back to pre-war levels when the war ended? Nope. The top rate did fall from 77 percent to 25 percent — but that still was 18 points higher than the top rate before the war. Then Franklin Delano Big Government came to town. The top rate shot back up to 78 percent by 1936. In the 1940s, another war came along and the top rate skyrocketed to 94 percent. And did taxes go down following World War II? Nope. This time, the top rate stayed above 90 percent — into the early 1960s. In 1960, John F. Kennedy got elected by promising to get America moving again. He pushed for -- but didn't live to see -- the top rate reduced from 90 percent to 70 percent under the Revenue Act of 1964, and his reductions did spur economic growth. So, when politicians realized that lower taxes resulted in more growth and productivity, they eagerly reduced income taxes further, right? Ha, ha! Nope. The income tax wasn't reduced again until Ronald Reagan took over. In 1981, the top rate was reduced to 50 percent. In 1986, in return for elimination of loop holes, the top rate was reduced to 28 percent. Reagan's tax reductions helped spur the longest peacetime period of growth in American history.

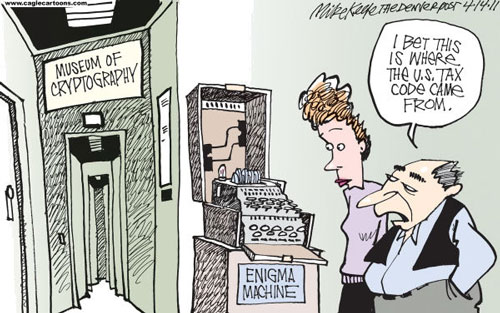

US Tax Code

Not exactly. First, loopholes that allowed taxpayers to avoid paying taxes were eliminated in 1986. Even though rates were higher in the past, actual taxes paid were lower. I stumbled across my father's 1959 tax return; after his many deductions, he paid only 2 percent of his income in federal taxes. Second, Social Security and Medicare taxes have increased rapidly over the years. Taxpayers pay an additional 15.3 percent of their income to support these programs. (The Social Security tax was only 1 percent when the program began.) Third, Americans are paying taxes in several ways that many are not even aware of. We pay taxes on gas, utilities and phone usage. We pay property, sales and transfer taxes. And our states, counties and municipalities also tax our incomes. Add it all up and you'll discover that for every dollar you earn, you are lucky to keep even 50 cents. That's something to muse about as you are barricaded in a room all weekend, getting your income-tax return in order.

©2013 Tom Purcell. Tom Purcell, author of "Misadventures of a 1970's Childhood" and "Comical Sense: A Lone Humorist Takes on a World Gone Nutty!" is a Pittsburgh Tribune-Review humor columnist and is nationally syndicated exclusively by Cagle Cartoons Inc. E-mail Tom at Purcell@caglecartoons.com Publish A Letter in SitNews Read Letters/Opinions

|

||