My Father's 1959 Tax Return April 17, 2012

For 1959, my father paid a measly 5 percent in federal taxes, even though his name wasn't Rockefeller. How did he do it? It was easy. For a year when the top income tax rate was 91 percent -- President Kennedy would slash rates a few years later -- deductions were many.

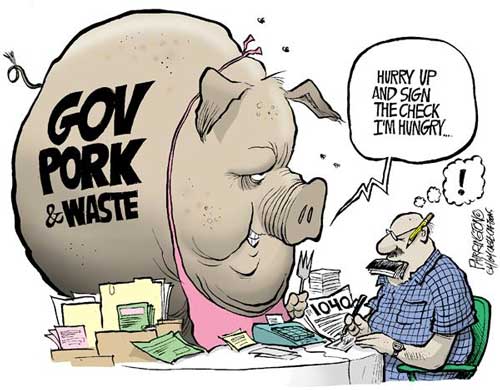

Tax pork

He was a heavy smoker then -- who wasn't? -- and was able to deduct every penny he paid in cigarette taxes. He was able to deduct every penny he paid in gasoline taxes. If we had such a perk now, the federal government would go broke (that is, more broke than it is now). And he was able to deduct every penny he paid in state sales tax in Pennsylvania, another wonderful perk that would save the average Pennsylvanian a boatload in federal taxes every year. He took a $600 tax deduction for each of his two dependents, my sisters Kathy and Krissy -- a lot of dough relative to his income. For 2011, the deduction for each dependent is $3,750. On paper that is six times what my father got in 1959 -- but if properly adjusted for inflation it would be about $5,000 today. Here's one that grabbed my attention: In 1959, he paid only 2.5 percent of his income toward FICA (then, Social Security; now, Social Security, Medicare and Medicaid). Now, aside from a temporary 2-percentage-point FICA tax break, the average employee pays 7.65 percent and his or her employer kicks in another 7.65 percent. I, being self-employed, have the pleasure of paying the full 15.3 percent myself. Despite the 2-percentage-point break for 2011, I will write out a sizable check to bring current the more than $12,000 in FICA contributions I am on the hook for. In any event, my father had his fair share of simple deductions in 1959, which helped offset his federal taxes. That helped him keep his total federal tax tab at a measly 5 percent. Better yet, his tax form was one sheet of paper printed on both sides. He had no calculator, nor did he need one.

GSA Parties Need More Tax Dollars

Which is why I long for the simplicity he enjoyed back then. In 1959, the federal tax code was about 15,000 pages. Today, it is more than 70,000 pages. Unlike my father, who was able to calculate his taxes quickly, I spend days getting mine in order, so I can hand them off to my CPA, so he can tell me I owe lots more than I feared I would. This year, after all my deductions for business and pain and suffering -- including the agitations of owning a few rental properties and investing a boat load of dough renovating one -- I will pay about 25 percent of my gross income in federal, state and local taxes. I consider myself extremely lucky at that rate. Still, today on tax day April 17 (April 15's was on a Sunday this year), I look back fondly on 1959. I didn't pay a dime in taxes that year. I didn't waste a moment getting hundreds of receipts in order and panicking when my CPA told me what I owed. I wasn't born until 1962.

©2012 Tom Purcell. Tom Purcell, a freelance writer is also a humor columnist for the Pittsburgh Tribune-Review, and is nationally syndicated exclusively by Cagle Cartoons newspaper syndicate. Distributed to subscribers

for publication by Publish A Letter in SitNews Read Letters/Opinions

|

||