Open Season on Healthcare ConsumersBy TOM PURCELLDecember 15, 2015

Like millions of self-employed Americans who have been buying their own health insurance for years, my policy, which I had liked and wanted to keep, has nearly doubled in cost since Obamacare became law. What a fine policy mine was. I purchased it in 2005 when I moved back to Pittsburgh. It gave me broad access to lots of doctors and my maximum out-of-pocket cost could not exceed $1,500 a year. But Obamacare mucked it all up. First, I got a letter telling me my policy was canceled for failure to meet Obamacare guidelines. ("If you like your insurance, you can keep your insurance" my eye!) A few weeks later, though, the policy was reinstated for reasons neither I nor my insurer could ever figure out.

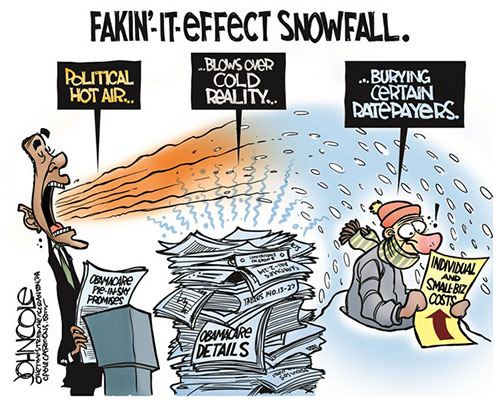

Obamacare Ratepayers

So, for the past two weeks, I've been logging many hours searching for lower-cost alternatives. I went to the Obamacare exchange and entered my information. The good news is that there are lots of plans that have monthly premiums lower than my current plan. The bad news is that the deductible costs are about $6,500 a year — $5,000 more than my current arrangement. In fact, to find a policy similar to what I have, I'd have to purchase the "gold" level, which is $200 to $300 more than the high premium I am paying now. So I looked into non-profit healthcare cost sharing ministries — faith-based organizations through which members voluntarily share each other's medical bills. Rather than pay a monthly premium to an insurance company, members send in a monthly "gift" at significantly less cost. Consider: A bronze plan for UPMC in Pittsburgh has a $6,500 deductible and a $300 monthly premium. A bronze plan for Christian Healthcare Ministries has a $5,000 deductible and a $45 monthly cost — that's right, only $45! There is no foolproof guarantee that such ministries will cover a member's medical costs — they are not required to keep a reserve — and they don't cover preexisting conditions or the outcome of non-Christian behavior, such as out-of-wedlock pregnancy. However, they've been around for decades and members report extremely high levels of satisfaction. If I go that route, I may also consider accident and indemnity insurance for added protection. An accident policy would pay a fixed amount if I suffer an injury to cover the cost of an ambulance ride or a hospital stay. An indemnity policy would cover me in the event of a serious health ailment, such as a stroke or a heart attack — both of which are likely now that Obamacare is legal. The truth is I'm not sure what I am going to do, but it agitates me to no end that I, and millions of others, have to work so hard to devise an affordable health insurance strategy. Obamacare has completely upended a system that the vast majority of Americans were happy with — drastically increasing our costs — in order to expand insurance coverage, says Forbes, to only 2.7 percent more Americans. That's madness. We could have expanded coverage to the small number of newly insured — the poor and those with pre-existing conditions — without disrupting one-sixth of the U.S. economy. That's why open enrollment is making me miserable. It's more like open season on healthcare consumers.

©2015 Tom Purcell. Tom Purcell, author of "Misadventures of a 1970's Childhood" and "Comical Sense: A Lone Humorist Takes on a World Gone Nutty!" is a Pittsburgh Tribune-Review humor columnist and is nationally syndicated exclusively by Cagle Cartoons Inc. E-mail Tom at Tom@TomPurcell.com Publish A Letter in SitNews Read Letters/Opinions

|

||